Navigating tariff roadmaps for automobile imports

- 164

- Entrepreneur

- 09:11 01/05/2022

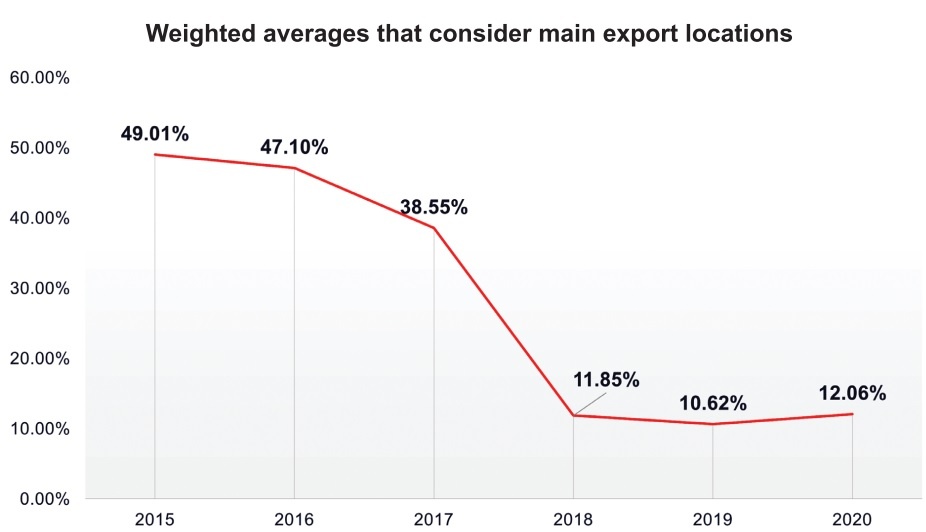

DNHN - The average tariff on imported cars in Vietnam has decreased from 49 per cent in 2015 to 12 per cent in 2020. As a result of changing car import tariffs over the past 5-10 years, Vietnam’s car imports shifted from high-tariff countries like India and China towards low-tariff ASEAN countries like Thailand (see graph). Several socioeconomic developments have triggered these changes.

Most importantly, the reductions on tariffs on imported cars are imposed by the ASEAN trade framework, which aims at substantially reducing protectionist measures among member countries. Tariffs on other non-ASEAN countries have not been changed so far. The observed average tariff reduction paid on imported cars has been mainly induced by a re-shifting of the demand for foreign cars from Indian and Chinese cars to those produced in Thailand.

This year, we have entered a new phase of tariff reductions as the Regional Comprehensive Economic Partnership (RCEP), of which ASEAN countries are all members, started to take effect. The RCEP includes key car-producing countries like China, Japan, and South Korea. Before the RCEP, these countries were imposed the high 65-75 per cent tariffs of third countries. It is foreseeable that these rates will decrease for RCEP members, making it possible to reduce prices for cars in ASEAN.

It is advisable to understand the roadmap for reducing car import tariffs and how it depends mainly on the free trade agreements Vietnam has signed. Agreements within the ASEAN led to a substantial tariff reduction for cars since 2015.

Within the RCEP, overall tariffs are planned to be completely eliminated until 2035, which should include cars. The implementation of the EU-Vietnam Free Trade Agreement should gradually eliminate tariffs on imported European cars until 2030. Furthermore, to improve the competitiveness of domestic car manufacturing, the government has eliminated tariffs on spare parts and car accessories since 2020.

These changes could result in easier access to modern, imported cars for the Vietnamese. From a social point of view, this would in turn contribute to lowering traffic accidents caused by outdated cars.

|

Intuitively, the connection is due to households having the possibility to obtain brand new cars with modern safety technology at cheaper prices thanks to the tariff decreases. These technologies aim at making the car a safer vehicle, indicating to the driver when technological problems appear, and also correcting potential driver’s mistakes.

This intuitive thought is furthermore backed by a statistical study I conducted in 2016 including a panel of 161 countries. The study showed that tariffs on imported cars contribute significantly to the deaths in road traffic accidents. In fact, an increase of the tariff by 10 per cent could increase deaths from accidents by 7.5 per cent.

Perhaps equally interesting are the implications of the tariff reductions on the automobile manufacturing and assembly industry in Vietnam. Compared to Thailand, the main car manufacturing hub in ASEAN, car production is estimated to be 20-30 per cent more costly in Vietnam as the infrastructure here is not yet as developed. This may be changed but massive investments from the private as well as the public sector would be necessary, while it may be unclear if these investments will achieve the desired benefits due to the harsh competition of other manufacturing hubs in the region.

Clearly, competition with foreign cars will hit the domestic industry hard. Domestic producers have the advantage of competitive salaries and capable workforce, but for professionals like engineers and designers the work prospects are more attractive in other countries. Hence, foreign companies may use Vietnam increasingly as a production hub but the cars will not truly be Vietnamese.

On the other hand, it will be very difficult for genuinely Vietnamese brands like VinFast to overcome the harsh competition that will only intensify. Some companies have become even stronger in the face of challenges, while others have disappeared. Clearly, the consumers will be the big winners of these changes, enjoying cheaper and better cars, be it from VinFast or foreign companies.

Furthermore, looming tariff reductions this decade will coincide with the next revolution which we will witness in the car industry: autonomous driving. Autonomous cars are being successfully tested around the world and will conquer the world sooner than we think. They will bring enormous benefits like massive accident reduction, worry-free traveling from police controls as the car does obey all the traffic laws, no accident insurance, no searching for a parking space as the car drops us and leaves, relaxed environment in a car designed to offer comfort, and does not bother about driving space.

Not only will this change the usage of private cars favouring car-sharing and taxi services. We may also soon say goodbye to the friendly taxi driver, while we use their service more than ever. This would be an unprecedented revolution especially for Vietnam. A car taxi ride will start to cost as little as a motorbike ride. Car-sharing companies together with Grab, Gojek and Vinasun cars will populate our roads more and more while private cars and motorbikes will slowly disappear.

Related news

- When Cryptocurrency leaves the "Grey Zone": How are Vietnamese investors seeking profits?

- When the tech unicorn dream is undermined by reckless fundraising structures

- From New Year messages of World Leaders to the “new rules” of the Global economy in 2026

- Connecting Leaders, Shaping the Future: Strategic Leadership Planning Meeting – CorporateConnections Hanoi A

- Sunlight - Unilever Vietnam Recognized for Outstanding Contributions to the National Initiative Supporting Women Entrepreneurs

- Deputy Prime Minister Nguyễn Chí Dũng: “The country’s major challenges weigh heavily on my mind — and we must resolve them together.

- Unitsky String Technologies signs cooperation agreements with three Vietnamese partners, opening a new direction for smart mobility and sustainable development

- When artists do business – livelihood is no poetry!

- Before the D‑day to abolish flat‑rate tax: Fear of technology and costs leave small traders struggling to adapt

- Vietnamese enterprises at a crossroads: the impact of a potential US–China deal

- "Digital technicians" must not be forgotten if Vietnam aims to meet its strategic goals

- HDBank: Impressive profit growth, leading in profitability and advancing international integration

- TNI King Coffee sued for over VND 5 Billion in unpaid debts

- VINASME and Jeonnam Technopark Sign MOU on technology cooperation, human resource training, and trade promotion

- Vietnamese entrepreneurs strengthen ASEAN connectivity in the digital iIntegration era

- Prime Minister: Vietnam aims to become a regional logistics hub

- Vietnam upgraded to Secondary Emerging Market by FTSE Russell

- Hanoi’s economy grows 7.92% in first nine months of 2025, FDI surges nearly threefold

- Vietnam’s strong gdp growth fails to ease labor market distress

- US tariffs on Brazil propel Vietnam’s pangasius into global spotlight

Đọc thêm Entrepreneur

Sunlight - Unilever Vietnam Recognized for Outstanding Contributions to the National Initiative Supporting Women Entrepreneurs

On 30 November 2025, at the review conference of Project 939 and the launch of Project 2415, Unilever Vietnam and its brand Sunlight were honored with a Certificate of Merit from the Presidium of the Vietnam Women’s Union (VWU).

The Entrepreneur calls on the government to resolve Vietnam’s critical logistics bottlenecks

Nguyễn Thị Bích Thủy, CEO of Trang Huy Logistics, spoke on behalf of many Vietnamese logistics enterprises.

Billionaire Bezos teaches Vietnamese entrepreneurs: “Don’t do business, be obsessed with customers”

Ranked the world’s fourth-richest person (Forbes, August 2025) with an estimated fortune of $241 billion, billionaire Jeff Bezos created the Amazon legend.

The Super Connector’s Playbook: The art of building soft power in the age of connection

In an era where technology is merely a tool, speed is no longer the ultimate edge, and attention has become the scarcest asset. Extraordinary success belongs not to those who are the smartest, but to those who are the most trusted.

The move of a Chinese businesswoman into Vietnam’s snack market

Recognizing Vietnam’s market potential, Chinese entrepreneur Liu Gengyan aims to develop a professional and distinctive snack store chain in the country.

Who are the two mysterious female tycoons holding 52 million HQC shares?

Two female tycoons have emerged as major shareholders of Hoang Quan Consulting-Trading-Service Real Estate Corporation (HQC), holding a combined 52 million shares, with investments totaling hundreds of billions of VND.

Young entrepreneur Lisa Phan: When you dream and act, nothing is impossible

Lisa Phan believes that a company’s success comes not only from good products and services but also from the way people treat one another.

Chopin: The magical piano – Touching the heart and emotions of the audience

THE YEAR 2024 MARKED THE RETURN OF PIANIST NGUYỄN VIỆT TRUNG WITH A SERIES OF REMARKABLE PERFORMANCES.

Request to thoroughly resolve real estate issues and avoid "criminalization"

The National Assembly requests a thorough resolution of real estate projects entangled with legal issues, avoiding the "criminalization" of economic and civil relations, and clarifying "no legalization of violations."

‘'Bầu Đức'’ and the banana revolution at Hoang Anh Gia Lai

Amid economic challenges, Hoang Anh Gia Lai (HAGL) has staged a strong comeback under the leadership of "Bầu Đức", thanks to banana cultivation.